The clash of geopolitical, economic, and technological forces has grown from a murmur to an annoying clamor as tensions ratchet up. A paradigm shift from an era of globalization into splintered, regional fiefdoms, broadly characterized by the East, led by China and the West, and dominated by the U.S., is changing how we view markets and ourselves. While the macro impacts of this change are significant, the question for retailers and brands is how and where will the clash impact our industry.

Motherland Meddling

Let’s start with how Chinese internal issues can cascade into the U.S. retail arena. There is increasing oversight of Chinese-owned ecommerce activity and governance by the Chinese Communist Party (C.C.P.). The party apparatus has cracked down on Alibaba, JD.com, Pinduoduo, Tencent, and others, while simultaneously intensifying scrutiny on livestreamed and social commerce. Such increased oversight might be dismissed as just a domestic policy issue, but these moves demonstrate the Chinese government’s influence over international trade and ecommerce activity at China-based and China-founded companies. It is fair to assume that U.S. consumers won’t punish Chinese e-tailers as C.C.P. involvement increases, as long as prices are low and supply aligns with demand. But consumers may perk up if the user experience is impacted as the power dynamics shift from tech founders, management, and ecommerce experts to the party. Additionally, already anxious legislators in the U.S. could disrupt ecommerce operations for security reasons.

American consumers don’t care about the current geopolitical tussling between The U.S. and China. They are equally unenthusiastic about the recent Congressional hearing with TikTok CEO Shou Chew, and the emphasis on new buzzword de-risking and disentangling the nation’s reliance on Chinese manufacturing.

Consumers Just Consume

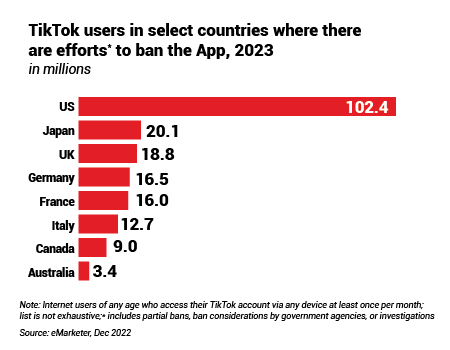

I contend that American consumers don’t care about the current geopolitical tussling between The U.S. and China. The country’s focus quickly shifted from discussions about China trade tariffs in 2022 to inflation. They are equally unenthusiastic about the recent Congressional hearing with TikTok CEO Shou Chew, and the emphasis on new buzzword “de-risking” and disentangling the nation’s reliance on Chinese manufacturing. A potential wide-ranging TikTok ban dominated the news cycle for a few weeks (revitalized by Montana’s recent move to ban it), but the hearing did little to move the average consumer. However, it did prompt outrage from the approximately 150 million users of the app who raged against a potential ban.

Pragmatic marketers are sticking with TikTok. According to a March 2023 Capterra survey of U.S. marketing executives, 87 percent believe that TikTok aligns with their long-term marketing strategies while 59 percent agree that concerns over TikTok’s data privacy and national security are justified. The survey also noted, “47 percent agree that TikTok’s algorithm is not transparent, while 45 percent believe that TikTok spies on U.S. users. Just 31 percent of marketers say that brand safety concerns are a top challenge.”

Lightning Strikes for Chinese Ecommerce

Chinese companies Temu and Shien are on a roll and challenging the global ecommerce and fast fashion markets as they command ever-increasing market share. Insider Intelligence reports Temu went from zero to 44.5 million unique viewers from its launch in September 2022 through December, moving to number-12 in holiday traffic for digital retailers. That was before its splashy Shop Like a Billionaire Super Bowl commercial. Temu capitalizes on an ecommerce marketplace that sells clothing, small electronics, car parts, gifts, jewelry, and other goods at astonishingly low prices. Factories and merchants ship goods directly to consumers, exploiting legacy China-to-U.S. postal agreements while avoiding inventory, tariff, and customer service issues, as well as middlemen. In October 2022, MIT Technology Review reported that the company’s app beat Amazon, Walmart, and Shein combined in downloads.

Back in 2021, Euromonitor reported Shein was the world’s largest online fashion retailer, surpassing both Zara and H&M. The company operates a trend-based model, introducing sample styles, then ramping up production based on demand. The company has an increasing number of detractors, but also a committed Gen Z customer base, who regularly flaunts Shein hauls on TikTok, YouTube, and Instagram. The New York Times reports, “The ecommerce retailer has gained vocal critics who have questioned, among other things, its connection to China, accused it of stealing designers’ works, and pointed to how its cheap merchandise contributes to environmental waste.”

Turning a Back on China Policies

While Temu and Shein battle in the global ecommerce marketplace, both downplay purely Chinese suppliers and China-rooted corporate structures. Temu launched in September with Boston headquarters and its parent company Pinduoduo has recently shifted its company registration from Shanghai to Dublin, Ireland. Pinduoduo is less known to American consumers than Alibaba or JD.com, but according to CNN, the company has a market value three times that of eBay. Shein was founded in China but moved its corporate headquarters to Singapore in 2022.

Data suggest that the forces allied against Chinese apps won’t tame consumers’ appetite for their offerings. Here’s a quick economic crib sheet: The retail feedback loop begins with demand, as today’s consumers demand an almost limitless supply of both commodity and discretionary goods. Companies have to figure out how to supply them at competitive prices, marketers drive engagement, and consumers consume (this model applies to social media apps with a few semantic tweaks). Neither geopolitical, security, nor sustainability concerns are likely to impact the cycle. The unanticipated potential impact will arrive through legislation, geopolitical upheaval, or some wildcard event like a new global pandemic, a hot war between China and the U.S., or an extreme climate catastrophe.

Options and Opportunities

The force of change tends to get its way … eventually. Thinking ahead, TikTok-dependent brands should have an alternative social strategy in place should the popular app be banned. If China-connected ecommerce apps experience similar pressure, an on-demand retail opportunity could emerge for Amazon, Walmart, and other retailers and brands.

In a recent podcast, Felix Salmon, Chief Financial Correspondent for Axios News summed up his perspective, “We have killed globalism, it is not coming back. It is well and truly dead at this point. The lovely relationship between the United States and China that benefitted both has become extremely fraught. We have a general mistrust of sourcing everything we need from China.” Salmon has a point, the mutually beneficial relationship that has buoyed U.S. consumer culture and Chinese development is increasingly under stress, but I don’t believe that globalism is dead. Rather, it is pivoting as companies decouple and de-risk from China.

As the seemingly ceaseless cycle of disruption continues, foresight and monitoring of both signaled and realized change will serve prepared brands and retailers well in the future. Chinese disentanglement will be painful for many businesses, but as our industry moves from any existing paradigm to the inevitable next, it is wise to respond to emergent threats and anticipate prospective opportunities.