The UK retail industry has navigated multiple periods of consumer uncertainty, including the pandemic and the cost of living crisis. Over the next couple of years, the retail industry will undergo significant transformation, shaped by evolving consumer behaviours, technological advancements and potential political and economic changes.

Join Mintel as we provide a snapshot of the UK retail market landscape – including insight into other global regions – highlighting opportunities, challenges and emerging trends that will define the industry’s trajectory in the near future. For a comprehensive retail industry analysis, covering 18 retail sectors, including how the 10 largest retailers in the UK have ranked against one another for the past 5 years, you can purchase our UK Retail Rankings 2024 Report.

Economic Outlook of the UK Retail Industry

The UK retail market experienced a second consecutive year of high inflation in 2023, leading to a focus on essential items and a challenging environment for discretionary categories. While retail sales grew in value terms, this growth masked an underlying volume decline.

Moving forward, Mintel’s retail industry insights reveal that the market is expected to show a mix of conservation and moderate growth, buoyed by rising consumer confidence and increased disposable incomes. However, the performance across different sectors varies. E-commerce continues to grow, albeit behind the wider retail sector, recording a 3.9% increase in online sales, driven by the convenience, diversity and value perception among consumers. In contrast, brick-and-mortar stores face ongoing challenges, including reduced foot traffic and heightened operational costs.

UK Retail Market: Sector Performance

The inherent necessity of the grocery sector means that the demand for this category remained insulated and relatively stable, even during financial turndowns. According to Mintel’s Supermarkets Market Research, the grocery market size is expected to grow to £241 billion in 2028. However, this doesn’t mean consumers aren’t adopting savvy shopping behaviours in response to the increased prices, with 73% of UK consumers spending more time looking for the best deals in food stores. Correspondingly, the German food discounters Aldi and Lidl both secured a spot in the top 10 retailers in the UK.

While grocery demand continued to outpace non-food categories, store-based fashion saw an uptick in volume growth in 2024. This upswing can be attributed to a weaker comparative performance in fashion retail during 2023 and stronger consumer demand as out-of-home footfall recovered, boosted by over six in ten Generation Z and Millennials having bought clothes in-store in the last 12 months. To help maintain post-pandemic interest, several clothing specialists are expanding into new categories like beauty and personal care to boost revenue opportunities. Leading the way is Marks & Spencer, which has added beauty retailer Estee Lauder Fragrance and introduced its own Fresh Elements skincare range to its offerings.

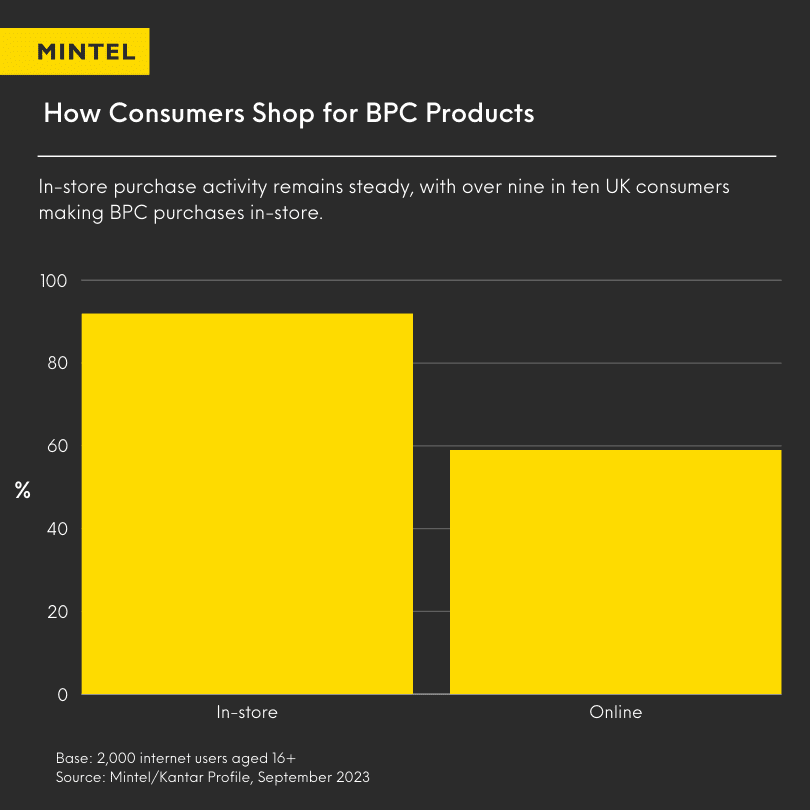

As seen during other times of economic adversity, the “Lipstick Effect” struck again. Consumers, facing tougher times, turned to the retail therapy of beauty products, indulging in affordable luxuries to brighten a bleak economic picture. Beauty and personal care purchase activity remains steady within the retail market, with nine in ten UK consumers making BPC purchases in-store. However, online purchases are on the rise, with three-fifths of Brits making online BPC purchases. One reason behind this increase is that consumers can read reviews and compare products freely. Similar in-store buying trends can also be found across the pond, with two-thirds of Canadian category buyers having made a BPC purchase at a drug store and almost seven in ten US Americans prefer to purchase in-store, expressing a preference for sampling products before purchasing.

The higher ticket home categories have struggled in 2023/4, reporting a decline in comparison to the significant boost seen during the pandemic, when the nation had more time to spend at home due to lockdowns, giving them an opportunity to complete DIY projects . The cost of living crisis has hampered consumers’ discretionary spending and led consumers to prioritise spending areas outside of home improvement, resulting in a decline in volume terms in major home categories such as furniture, household appliances, and DIY. In a bid to diversify, the DIY retail market has shifted their marketing and innovation efforts towards smaller ticket home improvement projects such as painting and decorating, to help consumers update their spaces in a budget-friendly nature.

Online sales have settled post-pandemic, with occasional spikes during events like Black Friday. The proportion of online sales has stabilised at around 25-27% of total retail sales in 2024. Even though the growth of the online market was behind the growth of the wider retail sector, three-quarters of UK online shoppers say that the best prices are found online, helping the sector insulate demand with a positive value perception.

A full and comprehensive breakdown of 18 retail sectors and leading retailers’ performance in those sectors, including Footwear to Food, and Health and Beauty to Homeware and many more can be found in our full Retail Rankings 2024 Report.

Retail Industry Trends and Opportunities

Enhanced consumer experience through community retail

Retail spaces are evolving to provide more than just products; they are becoming community hubs, places where consumers can engage in enriching experiences. This includes creating spaces for socialising, learning and hosting community events, which helps to build emotional connections between the retailer and consumer and therefore enhance customer engagement and loyalty. One retailer that is successfully innovating in this emerging community retail space is Gymshark. Founded in 2012 as an online-only direct-to-consumer (DTC) brand, Gymshark opened its flagship store in Regents Street, London in 2023. The store brings Gymshark’s functional fitness but fun ethos to life by hosting experiential elements, from one-to-one personal training stations to in-store Sweat Classes. This fitness brand’s entry into physical retail will hopefully encourage courageous moves from other online-first brands to expand into the physical space, something which is critical for the future of the high street.

Nick Carroll, Mintel’s Director or Retail Insight, talks through what store-based retailers can learn from the Gymshark flagship store.The rise of the circular economy

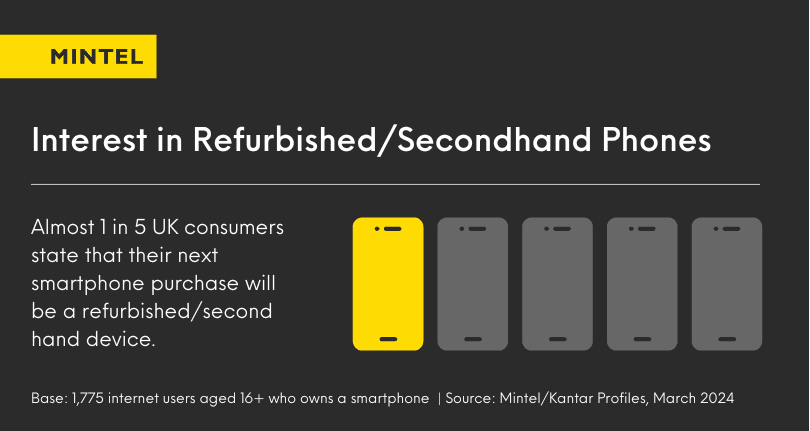

Consumer demand for sustainability and circular economy practices is multiplying across the UK retail market. As consumers become more environmentally conscious, they look to retailers to lead by example to source eco-friendly products and reduce the size of their carbon footprint. One notable sustainable retail industry trend is the rising interest in the secondhand economy. Mintel’s retail industry insights report UK Brand Overview reveals that two-fifths of consumers have purchased secondhand products. Even in the US, the secondhand market is expected to grow, particularly in the smartphone sector, influenced by the perception that smartphone innovation has peaked (alongside the financial and environmental benefits). Over a third of US Americans have previously chosen to buy a refurbished phone, and Mintel predicts this will continue to rise, especially amid times of financial turbulence. Brands are encouraged to leverage this trend to build customer loyalty, appeal to consumers’ money-saving interests and demonstrate sustainability commitments.

One standout retailer who is innovating in this space is the Finnish brand Swappie which introduced vending machines that allow consumers to buy, sell, or recycle second-hand smartphones, aiming to increase the reuse and recycling of old phones. This model offers 24/7 access and convenience, encouraging circular habits among consumers.

This circular practice extends into the fashion sector where almost half of Germans and 16-34-year-old Brits have bought secondhand clothes. By buying secondhand clothes, consumers can align their environmental values by promoting reuse, reducing the demand for new production and contributing to a more circular fashion industry. The German brand Zalando is a great example of a company pushing fashion into higher circularity. In 2021, Zalando rolled out a care and repair service to engage with consumers post-purchase and to help extend product life as much as possible. Schemes like this appeal to consumers’ heightened focus on eco-friendly interests while building a brand-consumer relationship built on trust and longevity. Buy your copy of Retail Ranking 2024 Report today

Technology changes the retail shopping experience forever

Staying competitive in the retail sector requires continuous innovation. This means that a multiplying number of retailers are introducing tech-driven products and services to help attract new customers and enhance customer loyalty. Innovations such as AI-powered customer service can help track consumer preferences and in turn, make real-time recommendations that are personalised to the user. An example of a standout initiative was B&Q and Screwfix’s owner Kingfisher who recently launched the first AI-powered assistant in the home improvement and DIY sector. Using generative AI to support customers at home with their DIY projects, the AI assistant provides step-by-step advice on a range of home improvement projects as well as tailored product recommendations. This use of AI perfectly illustrates how shopping experiences can be uniquely personalised and can help enhance overall customer satisfaction.

Challenges for Brands in the Retail Industry

- Economic uncertainty and consumer savviness

Faced with rising inflation, brands in the retail market need to consistently demonstrate value to consumers, which will help alleviate the economic pressure forcing cutbacks in discretionary spending. Post-pandemic, consumers have adopted savvy shopping behaviours and become more value-conscious, often seeking the best prices through online research and social media reviews. Since Mintel predicts that this trend is likely to persist, retailers will need to focus on providing competitive pricing and value propositions such as focusing on efficiency, multifunctional products with long-lasting claims, loyalty schemes and trial offerings. - Ongoing supply chain issues

Mintel’s Retail Rankings 2024 Report outlines that supply chain resilience remains a critical issue for retailers. More than half of retail executives are concerned about supply chain disruptions impacting their operations in 2024/25. These disruptions are attributed to factors such as geopolitical instability, logistical challenges, and raw material shortages. Rising costs and supply shortages will continue to challenge both the retailer and the consumer since increased operational costs limit retailers’ ability to protect prices for the consumer. To mitigate this challenge, retailers need to implement advanced supply chain analytics to support maintaining supply, in addition to diversifying suppliers by supporting local brands. - Technological integration

The retail industry’s digital transformation has heightened the sector’s vulnerability to cyber threats, with significant incidents reported to the Information Commissioner’s Office. Retailers face an important stage in their digitalisation where they must implement robust security measures such as encrypted data storage, regular audits and cross-company employee training programs to safeguard sensitive information and maintain consumer trust.

As discussed earlier in this article, the impact of AI in customer-facing areas within the retail market is growing rapidly. However, the pace at which retailers plan to leverage AI capabilities is outpacing consumer awareness, with nearly a third of consumers not knowing much about AI, even though they are aware of the term. While there is still scepticism and mistrust from consumers around AI, brands must resist the temptation of accelerating the adoption process and instead approach it with caution and establish clear communication when AI is used. According to Mintel’s Digital Lives of Consumers Report, over three-quarters of UK consumers agree that companies should make it clear when interactions involve AI. These findings reveal a desire for brands to be transparent and upfront about AI involvement, which should help brands manage consumer expectations and foster trust for a more positive experience.

Innovate in the Retail Market with Mintel

Looking ahead, the future of retail lies in cautious adaptation. While technological advancements offer exciting possibilities, the pace of change must align with consumer comfort. Additionally, the growing interest in the circular economy and sustainable practices presents a significant opportunity for retailers. By embracing these trends, brands can showcase their commitment to environmental responsibility and build stronger, long-term relationships with consumers. Economic downturns undoubtedly lead to savvier shopping habits, however, as consumer confidence and disposable income rise, a promising path lies ahead for the retail industry.

Curious where your brand stands against the UK’s top retailers? Our Retail Ranking Report 2024 delivers a deep dive into the past year, analysing:

- Sale densities: Identify top performers and benchmark your own sales strategy.

- Retailer performance: Discover key trends and innovations shaping the market.

- Category breakdowns: Gain insights into specific segments driving the UK retail landscape.

Gain a competitive edge and purchase your copy of our UK Retail Ranking Report 2024 today!